The solar industry's blind spot

In fall 2019, while overseeing technical due diligence for tax equity investments of wind and solar projects at a major bank, I faced a startling revelation. Project sponsors were notifying us of the economic nonviability of hail insurance for solar farms and exercising their right to not renew policies. This was the fallout from the Midway solar farm hail loss earlier that year near Midland, Texas, where a catastrophic hailstorm damaged over 400,000 modules, resulting in a reported $70 million insurance claim.

Our industry had made a critical misstep by deploying vast fields of glass in hail-prone regions like Texas without truly understanding the risks or implementing adequate defenses. Our reviews of hail risk had merely confirmed that PV modules met the typical International Electrotechnical Commission (IEC) standard for 25 mm diameter hail resistance—a size that would prove woefully inadequate—and relied on hail insurance to cap the risk.

Our mistaken overreliance on insurance became apparent when we faced the reality of policy nonrenewal. We had examined historical insurance trends, which showed remarkably stable rates and consistent policy renewals, leading us to believe insurance would always be available and affordable. We were lulled into a false sense of security, presuming that insurance underwriters had properly characterized the hail risk. As we would learn, that was far from correct.

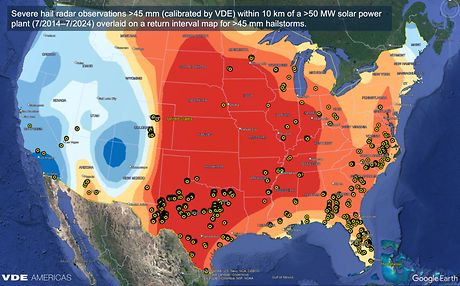

In fact, there was no good way of characterizing hail risk for solar projects at the time. Historical hail data, often based on claims, was scarce in remote project locations due to population bias. Moreover, vulnerability curves used for solar in leading catastrophe peril risk models were based on light metal buildings, not acres of glass. The Midway incident catalyzed the hardening of the hail insurance market, causing premiums to skyrocket, coverage to plummet, and in many cases insurance to become unavailable. This left operating projects at major risk of loss and made many projects yet to be completed unfinanceable without ironclad parent company guarantees to rebuild. That was something only the largest owners could offer that would exist as a liability on their books through at least the end of the financing period.

A quest for understanding and solutions

Driven by this dark realization and a legitimate sense of failure, I dove into researching hail risk and mitigation. I discovered ongoing work by Nextracker and the Renewable Energy Test Center (RETC) demonstrating how tilting modules significantly reduces hail damage—a process we now know as hail stow. For an imminent utility-scale Texas solar project, I included a requirement for hail monitoring and stow, and I added similar language to our group’s term sheet template for new deals.

That was just the beginning. I also needed a targeted and reliable hail risk assessment and mitigation strategy. With that in mind, I reached out to VDE Americas, our engineering consultant for solar technical due diligence. It responded by enlisting VDE’s Dr. Peter Bostock and Central Michigan University’s Professor John Allen, experts in physics and atmospheric sciences, respectively, to develop a new approach to characterizing hail risk using a combination of weather data, hail impact data on solar modules, and lots of math. This effort also led to the formation of a small team at VDE Americas dedicated to hail risk assessment for solar, which I now manage.

The Fort Bend County case study

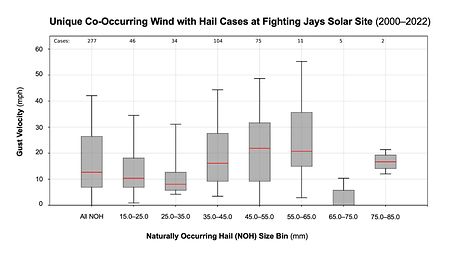

Nearly five years later, we’re seeing the benefits of hail stow in the public domain. My team recently collaborated with Array Technologies on a study of severe hailstorms in Fort Bend County, Texas, during March 15–16, 2024—the same storm system that significantly damaged the Fighting Jays solar project.